This issue of the Evergreen Virtual Advisor (EVA) is our monthly edition of insights from our partners at Gavekal. Thankfully, its subject matter gives readers a chance to shift their focus away from America’s political circus, which seems to be growing more surreal by the day.

You will soon read that the US is not alone in experiencing the rise of anti-establishment political figures opposed to free-trade and immigration. (For those of you with a bit more time for intriguing reads, please click on this link to access a very personal piece from Gavekal’s Charles Gave on one of the root causes of Europe’s immigration crisis.)

On the other hand, for EVA readers interested in the ultimate speed-read, the following is a summary of the main article’s salient points:

- The grand European integration project—which brought the euro currency into existence in the late 1990s—was a flawed creation from the start.

- The prevailing political climate at the time prevented a full-scale union. Some type of crisis (such as the 2008 global financial panic) was needed to force the eurozone countries closer together. Since then, there has been halting progress toward tighter bonds.

- However, the flood of refugees from the Mid-East is working against this by threatening the essential open-border structure (known as Schengen).

- The refugee crisis is also fueling the rise of populist political parties, as has anger over European Central Bank (ECB) zero- and negative-interest-rate-policies that are threatening the income of Europe’s growing retirement class.

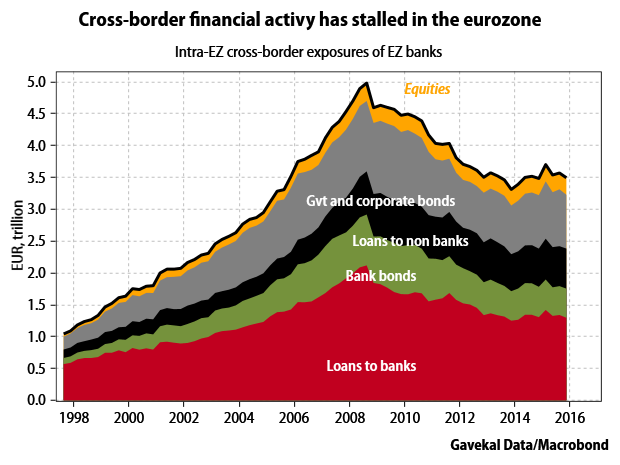

- The financial fragmentation since the Greek crisis of 2011 and 2012 (which caused, for example, German banks to shed Italian loans and focus on domestic lending) is aggravating the disunion forces. As a result, cross-border financial activity flows are declining.

- The European Union (EU) has been relying heavily on Greece and Turkey to provide sanctuary to the influx of refugees but this arrangement is fraying.

- The rising anti-union sentiment has made fiscal integration (like sharing tax revenues between northern and southern Europe) a virtual impossibility. Consequently, closer linkage is increasingly reliant on strengthening the eurozone’s fragile banking system and making it “trans-national” once again.

- While there are some encouraging developments in this regard, Europe’s great unification experiment is at considerable risk, one that will be hugely elevated this June should the UK opt-out of the EU (the so-called Brexit vote).

The grand old men who conceived of a united states of Europe knew that a successful single currency demanded a modern federation with integrated monetary, fiscal and political institutions. Such a leap into the unknown was politically impossible in the 1990s, and their assumption (and perhaps hope) was that the less than optimal eurozone would suffer periodic crises, so creating the conditions for reform and a centralization of powers. Since the 2008 financial crisis kicked off, that script has played out, at least partially. The trouble is that few game changing reforms such as eurozone-wide deposit insurance or fiscal burden sharing have been adopted. Instead, the dominant political-economic forces impacting the region are spurring disintegration rather than the hoped-for integration.

While European financial markets remain relatively calm due to massive central bank money transfusions, there is a bigger question about the European integration project, and whether it has again reached a point when investors start to doubt its sustainability. European equities are down more than 10% YTD, the yield curve keeps flattening as investors bet on more deflation and yield spreads in the periphery are widening.

The threat of the other

The refugee crisis has shown the notion of European “solidarity” to be a sham. Last year Greece was told that if it did not obey the rules and accept a Brussels-dictated bailout it would have to leave the EU. Less than a year later stronger countries showed how to protect their national self-interest with eight unilaterally imposing border controls in a move that challenges the core European Union principle of “free movement” for labor and goods. The European Commission estimates that re-introducing internal border controls would impose immediate direct costs of between €5bn and €18bn annually—or 0.05% and 0.13% of GDP. The road haulage sector alone faces extra costs of €1.7bn to €7.5bn. An additional €1.3bn to €5.2bn of working time would be lost due to delays incurred by EU workers crossing borders every day to go to their jobs. And should border controls become a permanent feature, several studies indicate a more serious impact: France Stratégie estimate it could cut trade between Schengen countries by at least -10% while Bertelsmann Stiftung finds that over a period of 10 years, the EU as a whole would suffer a €500bn to €1.4trn hit to economic output compared to having no border controls.

Here come the demagogues

The refugee crisis has also spurred on populist political movements which were born out of anger at high unemployment and low growth. Even in affluent Germany, the third most popular political party is now an anti-immigration, anti-euro outfit that in last month’s regional elections challenged Angela Merkel's Christian Democratic Union. Like other European populist parties, Alternative for Germany (AfG) is changing the terms of political discourse and forcing mainstream parties into more hardline positions. German leaders have even taken to blaming the rise of AfG on European Central Bank easy money policies which have hit the savings of pensioners. The overall impact is to force Merkel and other leaders to respond directly to domestic fears and limit the scope for the kind of compromises needed to deepen eurozone integration.

On the periphery, Spain has lacked a government since its inconclusive December election ruptured the two-party system. High unemployment, falling wages and endemic political corruption has spurred new parties such as Podemos which won almost 21% of the vote. Ireland also remains government-less after its February poll. Like Spain, the Emerald Isle is not especially Euroskeptic, with all the main parties being pro-euro, but the results have forced political actors to try and roll back reforms that impose economic pain. Something similar has been threatened by the one-time model pupil of Brussels, Portugal, where the socialist party has formed an anti-austerity coalition with the Communists.

Across the continent, Euroskepticism and angry nativism is on the rise. Poland's new government is nationalistic, authoritarian and highly critical of Brussels. Along with other eastern European countries such as Hungary it has rejected any system that involves it taking a quota of refugees. Similar dynamics can be seen in the “liberal” Netherlands where Geert Wilders's Party of Freedom has led many recent opinion polls and was successful last week in campaigning against a free trade deal with Ukraine that was the subject of a national referendum.

Perhaps, the biggest near term catalyst to European disunion is the UK’s Brexit referendum. A vote to leave would prompt an energy-sapping negotiation on the terms of Britain’s departure, but more importantly offer a clarion call to other Euroskeptic voters that there is an alternative to “ever closer union”. Even a vote to stay, especially if close, could energize other Eurosceptic movements to seek a looser relationship with their EU partners as the UK has managed to achieve with its renegotiation.

Financial fragmentation

The other big force threatening to rent asunder the eurozone is financial fragmentation or the reduction in intra EU financial flows. Absent a fiscal union, cross-border flows are the main integrating dynamic which can force some convergence within the single currency area. Such flows have become critical as creditors such as Germany show no sign of agreeing to big fiscal transfers, while the re-introduction of border controls could hinder already limited intra-eurozone labor mobility. To be sure, the recent re-domestication of credit funding is the result of Southern European banks getting cheap financing from the ECB through the TLTRO program (see chart overleaf). Yet as Charles likes to say, there is a high cost to free money; super low interest rates reduce financial stress, but banks have less need to own up to bad debt, while new “bail-in” rules make governments more reluctant to force banks into a restructuring. As a result, non-performing loans will remain on banks' balance sheets and lending will be constrained.

Kick starting financial flows is key as Southern Europe lags economies like Germany and Holland in education standards and skill levels, which have suffered from underinvestment due to austerity. Yet northern eurozone members are reluctant to commit to fiscal transfers and the rising tide of northern Euroskepticism means this will likely remain the case. The problem is that without such transfers the eurozone will remain a disintegrated group of states sharing the same currency, rather than a fully functioning economic and monetary union.

The risk that these centrifugal forces lead to a dismantling of the European project is non-trivial—perhaps as high as 40% compared to 20% two years ago. However, there is also a more constructive scenario such that a multi-year process drift toward disintegration is reversed. This needs two things need to happen: (i) European politics must normalize (ii) financial integration becomes the key driver of re-integration.

A long way to normal

With a potent combination of economic stagnation and fears of being inundated by immigrants, it is not easy to see what will spur European politics to return to “normal”. It is unlikely to be the EU’s expedient response to the refugee crisis which has relied on doing a deal with Turkey on relocation, whose legal validity could yet unravel. Greece remains a weak link for the EU; its calls for logistical and financial support to handle huge refugee arrivals on islands such as Kos have largely been ignored. Similarly, combined efforts to police the border are unlikely to make a material dent in arrivals given its tiny budget (€250mn compared to the equivalent of €29bn in the US). Nor is a commonly agreed burden sharing mechanism likely to be agreed for taking refugees—member nations agreed in September 2015 to relocate 160,000 refugees from Greece and Italy over two years. As of April 4, only 530 refugees from Italy and 581 from Greece had been relocated, mainly to France, Finland and Portugal.

Instead, and somewhat counterintuitively, the UK referendum over Brexit is the most likely catalyst for a normalization of European politics. If, as we think, pragmatic British voters ultimately opt for the “devil they know” then a major existential question will have been settled and a process of re-integration should unfold. The political discourse in Europe will likely swing towards more centrist solutions which is important just a year ahead of national elections in France and Germany.

Financial integration will be key

If, as we believe, European democratic politics can course-correct back toward the center ground, this is not to say that a rapid move to fiscal federalism beckons. The only recent initiative to adopt fiscal burden sharing has been Commission president, Jean-Claude Junker’s, plans to unlock €315bn of investment by 2018 using public funds and guarantees to back high risk projects. With no big fiscal transfers in the making, capital flows are left as the sole risk sharing mechanism to sustain the monetary union. There is potential for improvement on that front.

Reviving capital flows within the eurozone requires a sound banking sector and Europe took steps in that direction by shifting regulation from the national to the supranational level through its “banking union” outlined in 2012. Investors, however, are not persuaded as shown by European bank shares’ underperformance. The immediate cause of this weakness may be the profit-sapping impact of negative interest rates and the remorseless flattening of the yield curve, but arguably there are two key worries about the institutional framework in which banks operate.

- Single Supervisory Mechanism—When the ECB became the frontline regulator for the eurozone’s bigger banks in 2014 investors breathed easier in part because the shift followed an exacting test of banks’ asset quality. Of late, however, concerns have picked up about what horrors lurk on balance sheets, especially in the big European economy that has done least to overhaul its banks. While we remain concerned about Italian bank solvency, this looks like a country-specific problem since when the ECB took on its single supervisory role it was clearly identified that Italy accounted for about a third of the eurozone’s weak banks.

- Single Resolution Mechanism—Under the mechanism adopted in 2014 the responsibility for resolving failed banks sits with a single resolution board overseen by the ECB in conjunction with national regulators. The idea is to grant troubled institutions consistent and predictable treatment. However, recent refinements to the mechanism have spooked investors. The new rules constrain state-aid and make it difficult for the likes of Italy to create a state-backed bad bank as a mechanism for isolating bad debt. Investors in Portuguese bank bonds were unnerved earlier this year by their apparently erratic treatment, while in Italy banks must choose whether they take a government guarantee in return for writing down bad assets.

The automatic bail-in process and the transfer of decision-making authority to a supranational board is an untested innovation and so generates uncertainty. Still, the system must represent an improvement over the old regime of taxpayer-financed bailouts which had become politically unsustainable while reinforcing the negative feedback loop between bad banks and the sovereign’s credit worthiness. Markets should start to gradually price in the “benefits” of the new system.

In the meantime, the ECB sent a powerful signal with TLTRO II*— providing banks with ECB liquidity at potentially negative rates until 2021—that it intends to do its part and particularly help the credibility of banks in the periphery. This should help reduce financial credit risk in the periphery and encourage northern banks to lend money to the south instead of paying to park their excess liquidity at the ECB’s deposit facility. All in all we conclude that the centripetal forces pulling Europe’s peripheral regions toward the center (mildly) have the edge over the centrifugal pressures seeking to pull the union asunder—but it is a close run thing.

*Targeted Long-Term Refinancing Options II, essentially an ECB-funding program to pay banks to extend loans

OUR LIKES AND DISLIKES.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.